The rapid advancement of technology has made mobile wallet applications one of the most sought-after digital products of our time. The demand for these apps is growing at an incredible pace. Established players like PayPal, Amazon Pay, and Paytm are already popular in the market. These e-wallets provide users with an easy and convenient way to transact money, Pay bills, recharge their accounts, and make online purchases. Wallet apps are now accepted for Payments in various places, such as restaurants and movie theaters. Investing in

mobile wallet app development can be a highly beneficial decision for startups, businesses, or large enterprises. With the rising popularity of mobile wallet apps, this industry is poised for growth and can provide lucrative opportunities for those who choose to invest.

In this tutorial, we will look at how to create a secure mobile wallet app similar to Google Pay. Furthermore, we will learn advanced features, wallet application uses, and cost estimation for developing mobile wallet apps like Google Pay.

What is Mobile Wallet App?

A mobile wallet app is a type of digital application that enables users to conveniently store, manage, and utilize their Payment details for transactions directly from their mobile devices. With this app, users can convert their smartphones into digital wallets where they can securely keep their credit or debit card information, bank account details, and other Payment methods.

Mobile wallet apps offer users a hassle-free way to make Payments, transfer funds, and handle their financial transactions without needing to carry physical cash or Payment cards. In addition to these capabilities, these apps often come with extra features, like loyalty programs, coupons, and budgeting tools, designed to enrich the user's overall experience.

Mobile wallet apps have become ubiquitous, serving a variety of purposes, including retail shopping, online shopping, and bill Payments. These apps facilitate online transactions through registered mobile numbers or QR codes. Developing mobile wallet software requires careful consideration of all the features required to provide a seamless and satisfying user experience.

How to Create a Mobile Wallet App Like Google Pay?

The process of developing a digital wallet app like Google Pay follows a similar structure to the development of any digital product. It typically involves several stages, including product discovery, UI/UX design, development, testing, deployment, product launch, and ongoing maintenance and support. Each phase plays a crucial role in the overall success of the digital wallet app, and in the following sections, we will explore each phase in more detail.

Identify the Product

Product discovery is a critical step in the development of a

mobile wallet app such as Paytm and Google Pay. The development team must acquire information on the target audience, their behavior, preferences, and pain points throughout this phase. They must also conduct research on existing mobile wallet apps to see which features and functions are currently in demand. Based on the information acquired, the team may create a product roadmap and prioritize the features critical to the app's success.

Customized UI/UX

The design phase involves creating the user interface and user experience (UI/UX) of the app. The team must ensure that the design is user-friendly and visually appealing. They must also consider the branding and marketing aspects of the app, including logos, color schemes, and fonts. The team should create wireframes, mockups, and prototypes to test the design and gather feedback from the stakeholders.

App Development and Testing

Once the design phase is complete, the development team begins building the app. They use programming languages, frameworks, and tools to create the app's functionality, security, and performance. The development team should follow coding best practices and ensure that the app works seamlessly across multiple platforms and devices. In addition, the team should conduct manual and automated testing to identify and fix bugs and glitches in the app.

Launching a Digital Wallet App

The launch phase involves submitting the app to the respective app stores, including Google Play Store and Apple App Store. The team should ensure that the app meets the guidelines and policies of the app stores. They should also create an app listing that highlights the app's features and benefits. Additionally, the team should create a marketing plan to promote the app through various channels, including social media, search engine marketing, and email campaigns.

Ongoing Support & Maintenance

After the app is launched, the development team must provide maintenance and support to ensure that the app runs smoothly. They must fix any bugs or glitches that users report and update the app with new features and functionalities regularly. Additionally, the team should provide customer support to address any queries or issues that users may have.

Creating a mobile wallet app like Google Pay requires a well-planned approach, from product discovery to app launch and maintenance. By following these steps, the development team can create a successful mobile wallet app that meets the needs and expectations of its users.

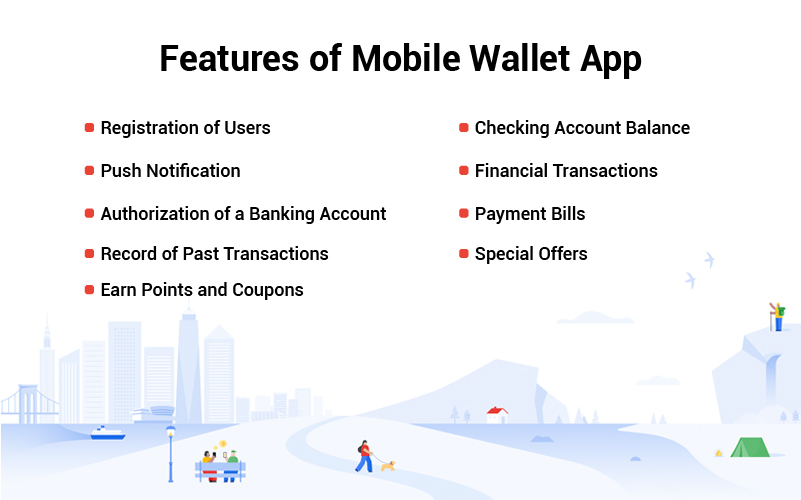

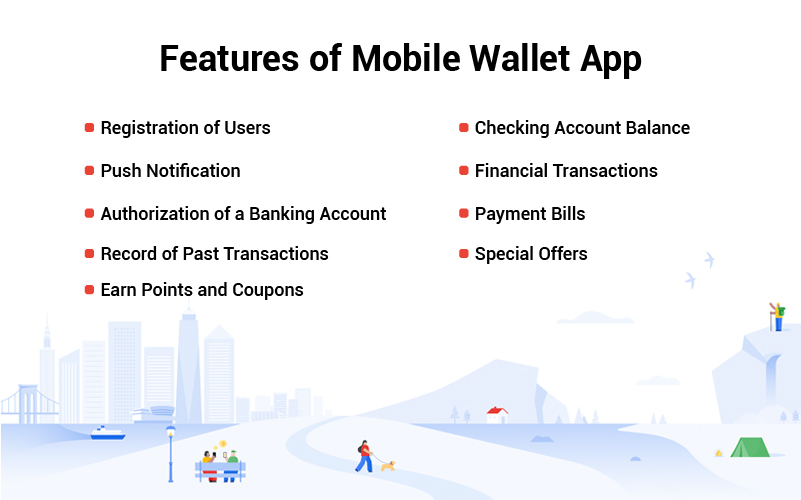

Features of Mobile Wallet App

A mobile wallet app is a convenient digital wallet that allows users to store, manage, and transact funds using their mobile devices. In this response, I will explain in detail the features of a typical mobile wallet app.

Registration of Users

The first step to using a mobile wallet app is to register for an account. Users will typically provide personal information such as their name, email address, phone number, and a password to create their account. Some apps may also require additional information such as a government-issued ID or proof of address for verification purposes.

Push Notification

A mobile wallet app will often send push notifications to users to provide real-time updates on their account activity. These notifications may include information on completed transactions, account balances, upcoming bill Payments, and exclusive offers.

Authorization of a Banking Account

To use a mobile wallet app, users need to link their banking accounts. This process requires authorization from the user, typically in the form of a one-time password (OTP) or a biometric authentication such as a fingerprint or face ID.

Checking Account Balance

Once the banking account is linked to the mobile wallet app, users can check their account balances in real time. The app will typically display the available balance, pending transactions, and any outstanding bills or Payments due.

Financial Transactions

Users can initiate transactions using a mobile wallet app. This includes sending and receiving money from other users of the same app, Paying bills, or making purchases from online or offline merchants that accept mobile Payments.

Payment Bills

Mobile wallet apps often allow users to Pay bills directly from their app, eliminating the need for manual bill Payments or visits to physical bank branches. Users can set up automatic payments or make one-time Payments for various bills such as utilities, phone bills, and credit card bills.

Record of Past Transactions

A mobile wallet app stores a record of all past transactions, providing users with a comprehensive transaction history. Users can use this feature to track their spending, monitor their account activity, and reconcile their financial records.

Special Offers

Mobile wallet apps may offer exclusive deals, discounts, or cash-back rewards to users for using their apps to make purchases. These offers can be based on user behavior, such as the frequency of transactions or the amount spent on transactions.

Earn Points and Coupons

Mobile wallet apps may offer rewards programs to incentivize users to use their app for transactions. Rewards can include cashback offers, discounts, loyalty points, or access to exclusive deals and events.

A mobile wallet app provides users with a secure, convenient, and efficient way to manage their finances. The app allows users to perform various financial activities such as checking account balances, making payments, sending and receiving money, and tracking their transaction history. Additionally, mobile wallet apps offer various rewards and incentives to encourage users to use their apps for financial transactions.

Uses of the Mobile Wallet Application

Mobile wallet applications are digital wallets that allow users to store their financial information, such as credit or debit card details, in one central location. These applications are useful for a variety of purposes, including:

One of the primary uses of mobile wallet applications is to make purchases using a mobile device instead of carrying a physical wallet. With a mobile wallet, users can Pay for goods and services by tapping their smartphone on a contactless Payment terminal, scanning a QR code, or entering a PIN code.

Mobile wallet applications can also be used to transfer money from one account to another. This can be useful for splitting bills, Paying friends or family, or sending money to someone in another country.

Many mobile wallet applications offer loyalty programs or rewards programs to incentivize users to use their apps. Users can earn points or cash back for purchases made using the app, which can be redeemed for discounts or other rewards.

Mobile wallet applications can also be used to Pay bills such as utility bills, phone bills, or cable bills, by linking the wallet to the user's bank account.

Some mobile wallet applications allow users to track their spending and set budgets for different categories. This can help users to manage their finances more effectively and avoid overspending.

Certain mobile wallet applications allow users to store their identification documents such as driving licenses, passports, or government-issued IDs. This can make the process of identity verification easier for users, especially when applying for loans or opening new accounts.

Mobile wallet applications offer a range of benefits such as convenience, speed, and security, making them an increasingly popular choice for managing financial transactions.

What are the Reasons to Consider Developing a Mobile Wallet App Like Google Pay?

There are several reasons why a business might consider developing a mobile wallet app similar to Google Pay. Here are many of the essential reasons:

A mobile wallet app offers convenience to users by allowing them to store all their Payment methods in one place and make transactions using just their mobile device. This can be especially useful for people who don't like carrying cash or multiple cards.

Mobile wallet apps like Google Pay use advanced security features such as tokenization and biometric authentication to protect users' financial information. This can give users peace of mind and make them more likely to use the app for transactions.

By offering a mobile wallet app with features such as loyalty programs, rewards, and personalized offers, businesses can build customer loyalty and encourage repeat purchases.

A mobile wallet app can provide businesses with valuable data about their customers' spending habits and preferences. This information can be used to optimize marketing strategies and improve the customer experience.

Developing a mobile wallet app can help businesses stay competitive in an increasingly digital world. By offering a seamless and convenient Payment option, businesses can attract and retain customers who value these features.

Mobile wallet apps can generate revenue through transaction fees, data monetization, and partnerships with other businesses.

Developing a mobile wallet app like Google Pay can offer numerous benefits to businesses, including increased convenience and security for users, customer loyalty and data insights, and a competitive advantage in the market.

What is the Estimated Cost of Creating a Mobile Wallet App Like Google Pay?

The cost of developing a mobile wallet app like Google Pay can vary substantially based on several factors. The complexity of the app, the features and functionalities incorporated, the platform(s) for which the app is being produced, and the location and hourly rates of the development team are all important elements that might influence the cost of development.

A basic mobile wallet app with basic Payment processing and security features, for example, may cost between $25,000 and $50,000 to design. A more comprehensive software with advanced features like loyalty programs, budgeting tools, and connectivity with numerous

Payment gateways, on the other hand, may cost $100,000 or more.

The time and resources required for testing, debugging, and releasing the app, as well as continuing maintenance and upgrades, can all have an impact on the cost of development.

Businesses can cut development costs by leveraging open-source software and pre-built components, outsourcing development to a team in a lower-cost locale, or working with a mobile wallet app development firm.

Conclusion

Creating a mobile wallet app can be a time-consuming, skill-intensive process that necessitates a significant amount of effort, knowledge, and investment. However, the resulting app has the potential to be a very useful tool for both businesses and customers. Businesses can successfully expedite the

app development process and create a top-notch mobile wallet app that caters to the specific requirements of their target market by following the steps mentioned in this article.

Mobile wallet applications have become the primary option for Paying bills and conducting transactions as technology has advanced. The days of waiting in enormous lines at bill Payment centers are over. People can now Pay their bills or transfer Payments from the convenience of their own homes. Mobile app development companies provide vendors and organizations with mobile Payment solutions, making it easier for them to take Payments. In today's digital world, creating mobile wallet software can be a profitable enterprise for both entrepreneurs and businesses.

If you want to develop a mobile wallet app like Google Pay, you can hire a mobile app developer or a mobile app development company that can help you develop a feature-rich mobile application. Hyperlink InfoSystem offers you the best mobile app development services, you can get whatever you want.