Credit Card Fraud Detection with Machine Learning in Python

Feb 2025

Digital fraud has become one of the main concerns these days because digitalization is expanding around the world. It is a serious problem if it involves money and customer's confidential data. The risk of such fraudulent activities is increasing and it targets businesses as well as individuals. Unauthorized online transactions, phishing scams, and other activities are the reason behind huge financial losses and damages.

Advanced technologies such as AI ML can be used to solve these problems. These technologies help develop fraud detection solutions. AI ML works with a huge amount of data, finding hidden patterns and catching fraudulent behavior in real-time. These technologies are integral to developing fraud detection solutions for credit card fraud and credit card scammers.

One of the most popular programming languages to develop solutions to detect credit card fraud is Python. Armed with tools such as Scikit-learn and TensorFlow, Python equips developers to design powerful and deployable credit card fraud detection models. We will explore building a credit card fraud detection solution using machine learning in Python in this blog.

Understanding Credit Card Frauds

This is called credit card fraud when another's credit card or a person's payment details are used fraudulently to make purchases or withdraw cash. This form of unlawful activity can cause significant financial losses and harms not only to individuals but also to organizations. Such scams eventually lead to loss of trust between companies and customers, also damaging the company's reputation.

There are numerous ways to commit credit card fraud in real life, such as identity theft, card skimming, phishing, CNP, lost or stolen cards, and many others.

Fraudsters can obtain the credit cards of victims by stealing their personal information and posing as someone else. While phishing schemes deceive the victims to give card credentials through phoney emails and messages or even a website that seems to be real, many thieves use skimming devices at ATMs or point-of-sale systems to capture the details of cards.

CNP frauds occur when the physical cards are not required for the transaction because it is being done online. Also, they use stolen or lost cards to withdraw money and to make purchases.

Types of Credit Card Frauds

Depending on what the scammers use to execute these actions, there are different types of credit card frauds:

- Transactional fraud:

Making illegal purchases with stolen or hacked information in cards is called this type of fraud. Such fraud primarily comes in the form of transactional fraud, either occurring in offline stores or online shops.

- Application fraud:

It occurs when thieves apply for new credit cards by using stolen or altered identities. This type of fraud can adversely impact a victim's credit rating and financial life and often involves identity theft.

- Account Takeover:

Hackers, when they gain unauthorized access to a legitimate cardholder's account, can perform transactions, alter account information, and move funds.

Knowing the different kinds of credit card scams and how they work will help businesses prepare themselves better to identify and halt such threats. Integrating artificial intelligence.

Also Read, AI in Inventory Management 2025: A Detailed Guide

The Role of Machine Learning in Credit Card Fraud Detection

Fraud detection is a critical component of modern financial systems, and machine learning is the key to increasing the precision and effectiveness of this procedure. Solutions powered by ML can scan vast datasets, identify complex patterns, and rapidly adapt to evolving fraud methods, which is not possible with classic rule-based systems that rely on pre-set criteria.

How Fraud Detection Is Improved by Machine Learning

- Finding Anomalies and Detecting Patterns

The machine learning algorithms are pretty good at finding the pattern in the data. In identifying credit card fraud, they observe spending patterns, transaction history, and behavioural trends. ML models identify an activity as suspicious if it is a deviation from the norm, as when a transaction from many places or a purchase is abnormally large.

- Big and Complex Data Management

Financial activities generate a lot of data. This data can easily be processed by ML models to identify fraudulent activity that is hidden amongst millions of valid transactions. Sophisticated methods like deep learning further enhance the ability to detect subtle fraud signals.

- Real-Time Fraud Detection

Credit card fraud prevention requires speed. Machine learning makes real-time fraud detection possible by analyzing transactions as they occur. Depending on the probability of fraud, models implemented in payment systems can quickly accept or reject transactions.

- Learning and Adaptability

Credit card fraudsters constantly come up with ways to beat systems in place, hence the changing strategies of fraud. ML algorithms are far more powerful than static rule-based systems as they learn from new data and adapt to fraud trends in real-time, especially when artificial intelligence is applied.

Key Machine Learning Techniques Used in Fraud Detection

Supervised Learning: Here, labeled datasets having examples of both fraudulent and legal transactions are used for training the models. The typical algorithms used here are Decision Trees, Logistic Regression, Support Vector Machines (SVM), and Random Forest

Unsupervised Learning: Unsupervised learning is used to identify anomalies because there is no prior knowledge of fraud. Finding outliers in transaction data is made easier with the use of clustering and dimensionality reduction techniques like PCA and K-Means Clustering.

Deep Learning and Neural Networks: It includes two of its major models: the CNNs (convolutional neural networks) and RNNs (recurrent neural networks). These two are used to create high accuracy in predictions for complex data patterns.

Credit card fraud detection now becomes smart, flexible, and incredibly successful by machine learning. Businesses can maintain a step above credit card scams and ensure the secure financial transaction using artificial intelligence and machine learning algorithms in fraud detection systems.

Developing a fraud detection model in Python

This includes the analysis and classification of transactions as either valid or fraudulent by using machine learning approaches. The following are essential procedures on creating a simple Python credit card fraud detection model in code snippets below.

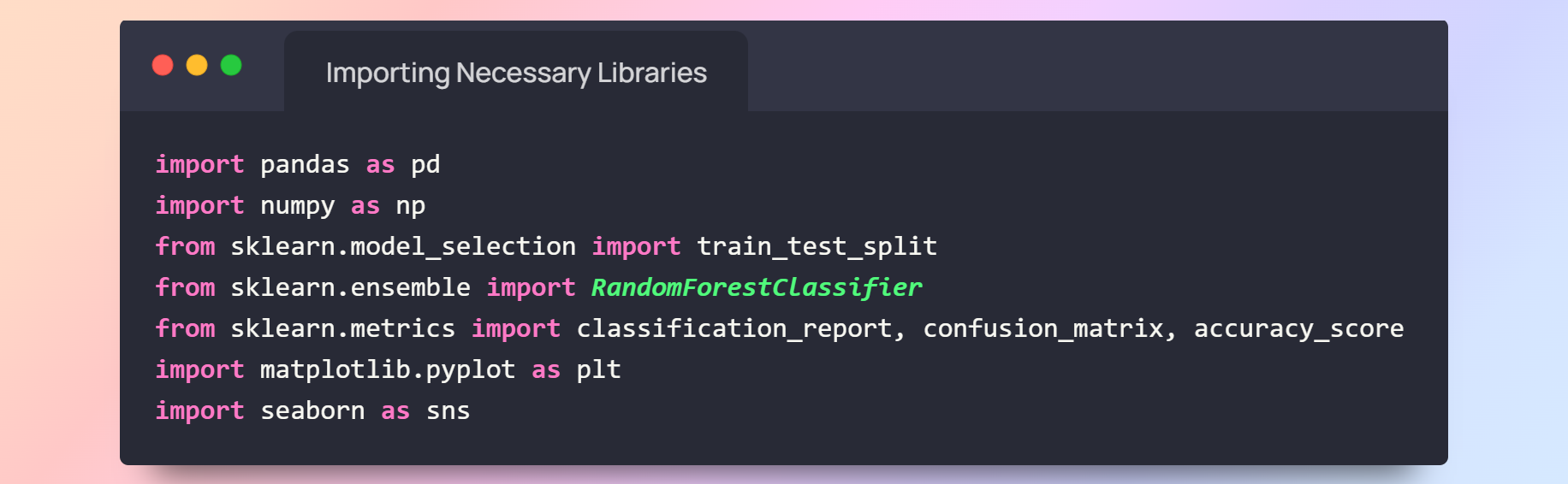

1) Importing Necessary Libraries

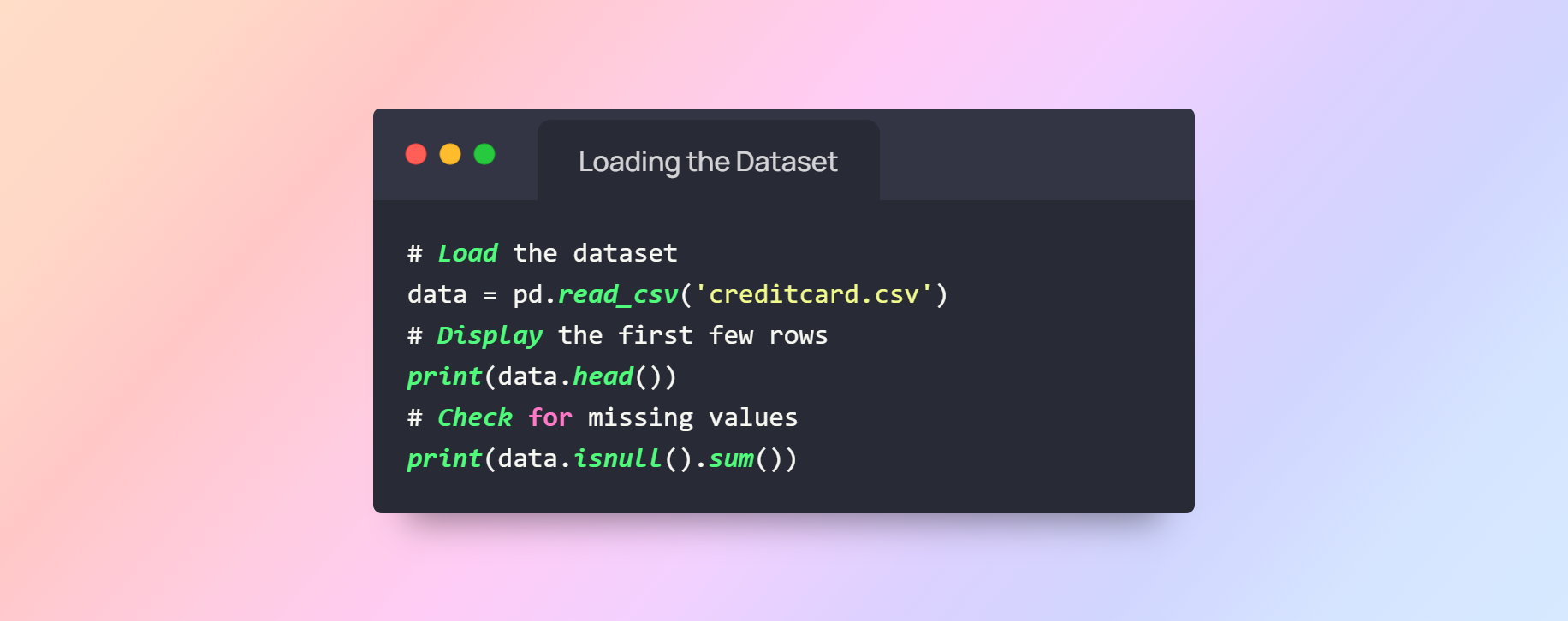

2) Loading the Dataset

For this example, we'll use a public dataset like the "Credit Card Fraud Detection" dataset from Kaggle. It contains real-world credit card transaction data.

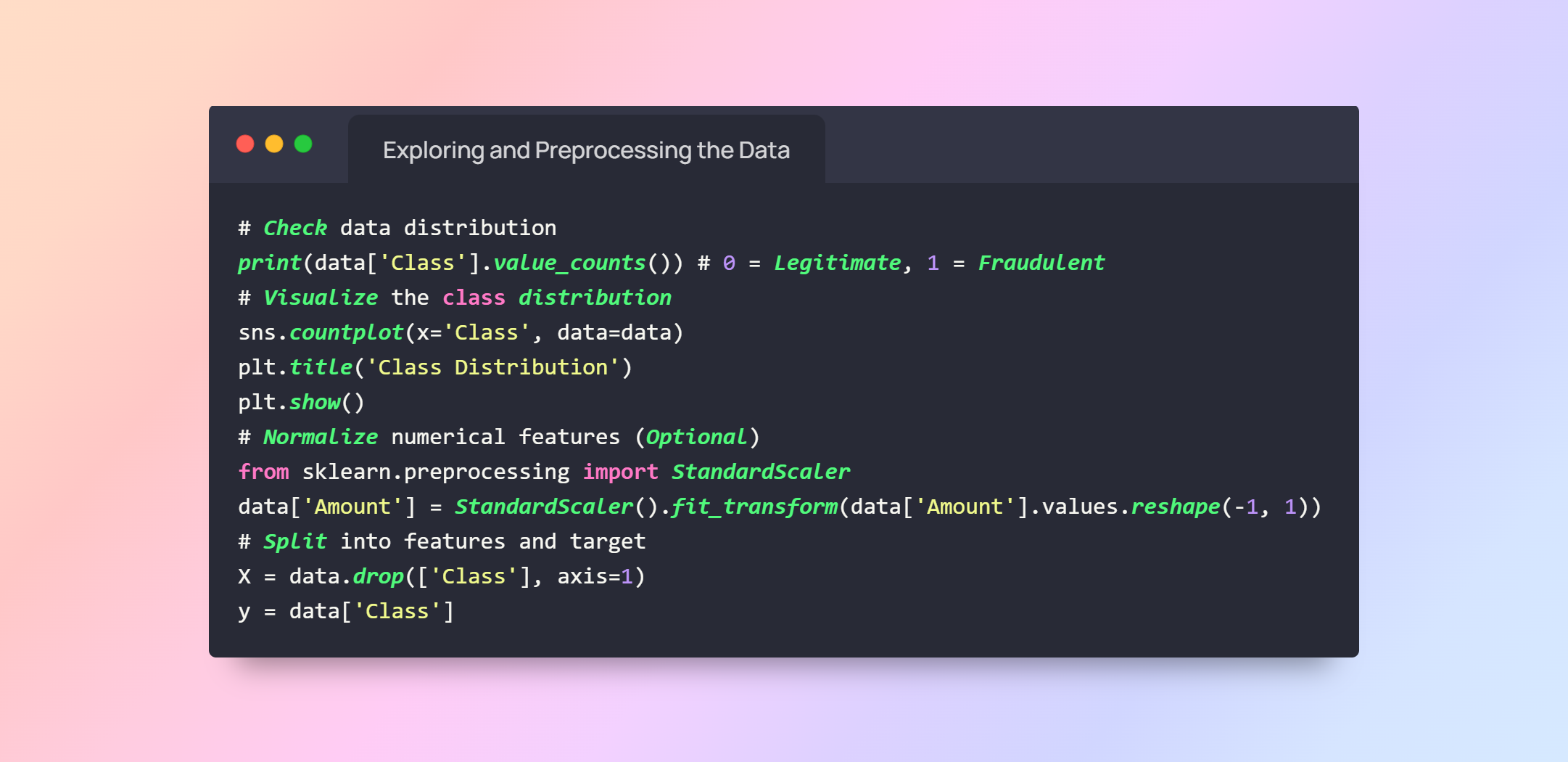

3) Exploring and Preprocessing the Data

4) Splitting the Data

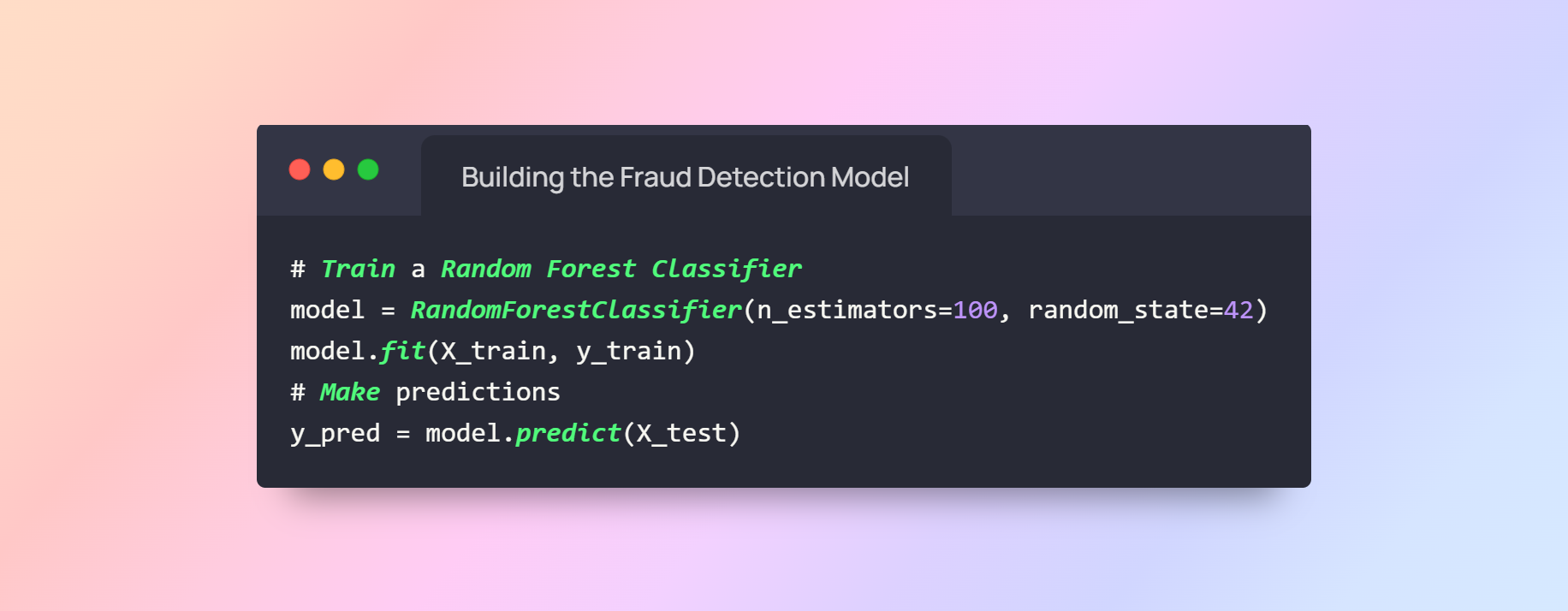

5) Building the Fraud Detection Model

We’ll use a Random Forest Classifier for this example, a robust and commonly used algorithm.

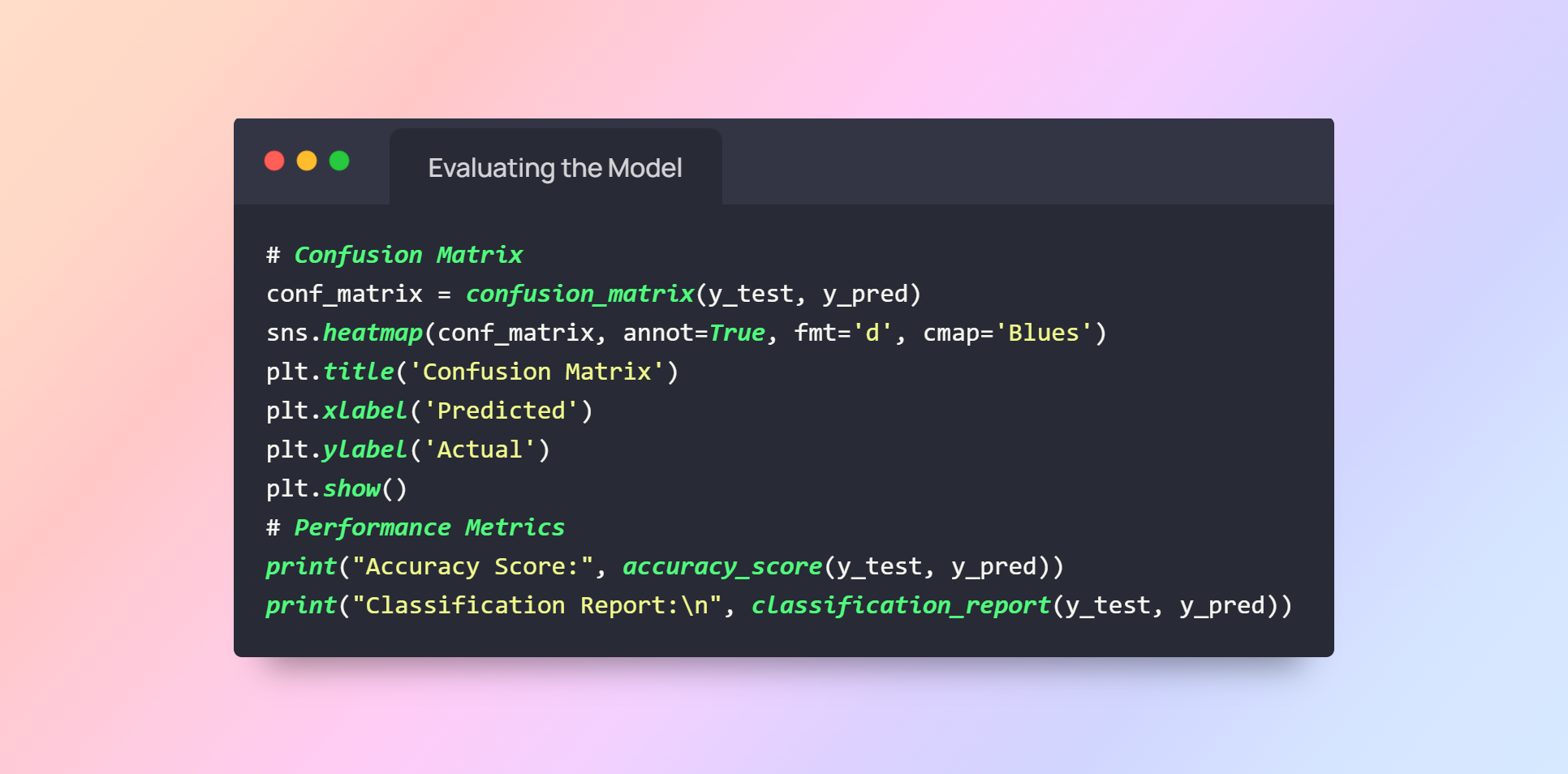

6) Evaluating the Model

7) Feature Importance

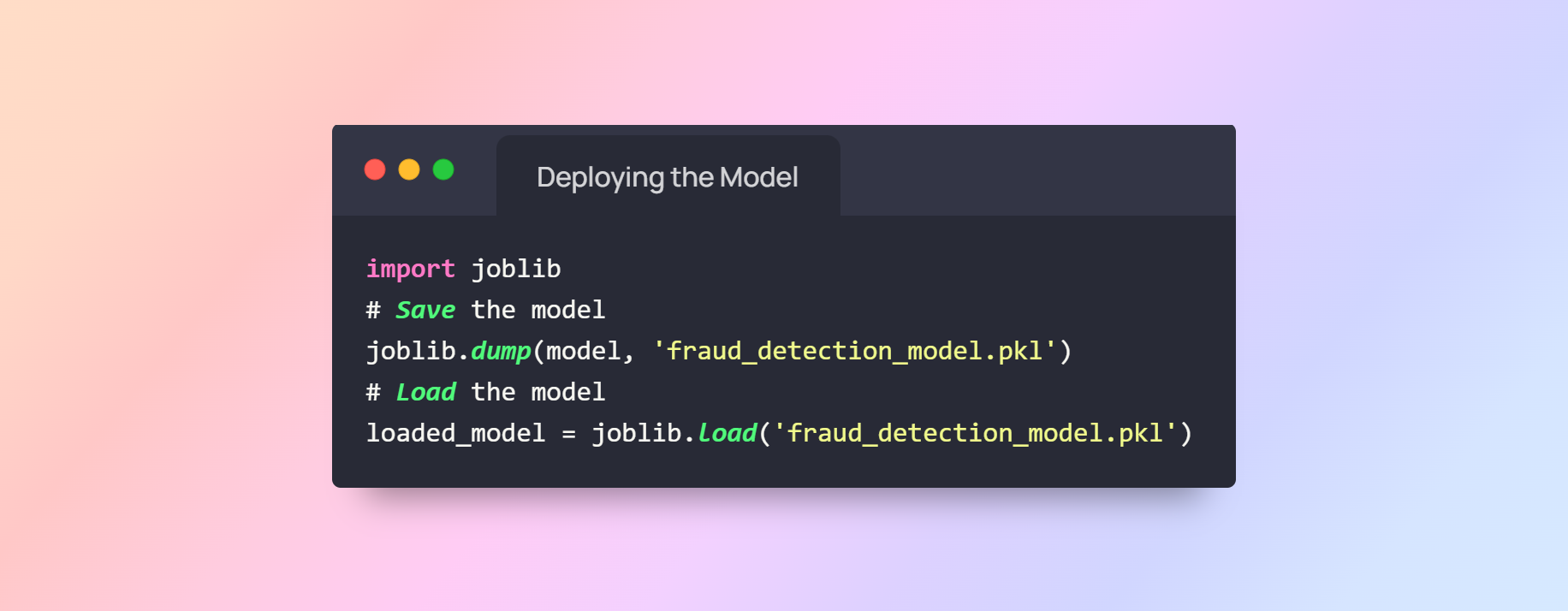

8) Deploying the Model

This all-inclusive guide has helped you to create a Python model for detecting credit card fraud. Although this example uses a simple model, accuracy can be improved by using deep learning or ensemble methods. Businesses can enhance their fraud detection systems and protect customers from credit card thieves through the use of machine learning and artificial intelligence, thereby reducing financial risks.

Also Read, Best AI Business Ideas for Startups In 2025: A Comprehensive Guide

Challenges in Credit Card Fraud Detection

Some of the major problems include:

1. Imbalanced Datasets

Problem: A highly imbalanced dataset is generated by fraudulent transactions that typically make up a very minor fraction of all transactions. Models that are biassed and can miss real fraud incidents but are more likely to predict legal transactions may result from this.

Impact: High false-negative rate; that is, fraudulent transactions being classified wrongly as genuine transactions.

Solution: This problem can be solved using cost-sensitive algorithms, undersampling, and SMOTE (Synthetic Minority Over-sampling Technique).

2. Evolving Fraud Patterns

Problem: Credit card fraudsters continually update their techniques to avoid being detected. Catching new types of credit card theft, for instance, synthetic identity fraud, is much more challenging.

Impact: Outdated or static models might fail to catch new fraud patterns.

Solution: Utilize adaptive models powered by artificial intelligence and machine learning that learn from and adapt to new data gradually.

3. Real-Time Detection Requirements

Problem: Fraud detection systems must run in real-time to protect users and prevent monetary losses. Real-time processing requires significant amounts of computing power and efficient algorithms.

Impact: Serious financial losses and loss of trust may result from delayed identification.

Solution: Implement high-performance, scalable solutions including cloud-based infrastructure and streaming algorithms.

4. High False Positive Data

Problem: Valid transactions could get identified as being a fraud due to overly sensitive fraud detection algorithms.

Impact: Customer inconvenience that leads to dissatisfaction and loss of trust.

Solution: Employ machine learning to fine-tune models to reduce false positives and find the right balance between recall and precision.

5. Lack of Detailed Information

Problem: Fraud-detecting systems rely heavily on adequate and diverse sets of data available. The model fails to identify fraudulent activity if the data is insufficient or non-existent.

Effect: Poor data training may make the models ungeneralizable to real-life conditions.

Solution: In order to derive accurate models, it would be advisable to merge real-time data streams, third-party data, and transaction history.

6. Security and Privacy Concerns

Problem: Processing and analyzing user transaction data poses privacy and compliance risks with regulations like CCPA and GDPR.

Impact: Failure to address privacy issues may lead to reputational and legal risks.

Solution: Ensure compliance by applying privacy-preserving techniques such as differential privacy and data anonymization.

7. Scalability Issues

Problem: As businesses grow, more transactions occur, and detection systems must scale seamlessly.

Impact: Performance degradation or latency may be experienced in systems that cannot scale.

Solution: Scalable architectures such as cloud-based machine learning platforms and distributed computing.

8. Interpretability of Machine Learning Model

Issue: Many complex machine learning models, including deep learning, are sometimes viewed as "black boxes," which makes it difficult to understand how decisions are being made.

Impact: If such automated fraud detection systems are not transparent, they will lose credibility.

Solution: Use XAI techniques to make model decisions more understandable and transparent.

9. International Trade and Deception

Problem: Because of the variation in laws, currencies, and fraud trends, international transactions are more prone to fraud.

Impact: Gaps in fraud prevention result from inconsistent detection across regions.

Solution: The answer is to use global fraud detection models that have been locally adjusted to account for regional differences.

10. Resource and Cost Constraints

Problem: The development and maintenance of effective fraud detection systems are resource- and cost-intensive.

Impact: Small companies might not be able to invest in new technology.

Solution: Reduce the expenses by partnering with fraud detection companies and utilizing cloud-based machine learning technologies.

Must Read, AI in Customer Services: How it’s Changing the Tech Game

Hire AI Developers for Fraud Detection Solutions with Hyperlink InfoSystem

With the help of machine learning and artificial intelligence, Hyperlink InfoSystem is a great fraud detection solution, which can help businesses stay one step ahead in the battle against credit card theft and scammers.

Our experienced developers know how to create personalized systems that detect illegal transactions and fraudulent trends, adjusting to new threats. With knowledge in data science and artificial intelligence, we offer you solutions that are reliable and instant, saving time to effectively protect your business and its clients.

Working with Hyperlink InfoSystem allows you to tap into a pool of dedicated AI developers who are keen on security, scalability, and GDPR compliance. We offer smooth, affordable solutions to protect your financial activities, whether you need to enhance your current system or build one from scratch. Hire Hyperlink InfoSystem's skilled AI developers to strengthen your fraud defenses now!

Conclusion

In a time where credit card frauds are highly complex, there is a high demand for reliable detection using AI and ML. With its flexibility, abundance of libraries, and efficiency, the Python programming language is ideal to be used to create effective and efficient fraud detection systems. Businesses would thus be placed in a proactive position to evolve risks and thereby safeguard their customers and operations in changing times, applying advanced tactics like anomaly detection, supervised learning, and real-time analytics into their systems.

Hyperlink InfoSystem is a niche where we deliver customized AI-based solutions to solve the specific issues of fraud detection. We empower companies to build secure, scalable, and efficient fraud prevention solutions by having a team of skilled AI engineers and knowledge of the latest technology. Join hands with us to ensure your financial transactions' security and your company to stay ahead in the curve of fraud battle.

Frequently Asked Questions

Detection of credit card fraud is the identification of fraudulent or unauthorized transactions for the protection of cardholders and financial institutions against financial loss.

Common types include identity theft, card skimming, phishing, application fraud, and account takeovers.

Yes, real-time fraud detection is possible using techniques like anomaly detection and predictive modeling with streaming data processing frameworks.

AI can analyze vast amounts of data, identify subtle patterns, and adapt to new fraud strategies faster than traditional methods.

Latest Blogs

Is BlockChain Technology Worth The H ...

Unfolds The Revolutionary & Versatility Of Blockchain Technology ...

IoT Technology - A Future In Making ...

Everything You Need To Know About IoT Technology ...

Feel Free to Contact Us!

We would be happy to hear from you, please fill in the form below or mail us your requirements on info@hyperlinkinfosystem.com

Hyperlink InfoSystem Bring Transformation For Global Businesses

Starting from listening to your business problems to delivering accurate solutions; we make sure to follow industry-specific standards and combine them with our technical knowledge, development expertise, and extensive research.

4500+

Apps Developed

1200+

Developers

2200+

Websites Designed

140+

Games Developed

120+

AI & IoT Solutions

2700+

Happy Clients

120+

Salesforce Solutions

40+

Data Science