For any business seeking to accept online payments with security and effectiveness, the need to integrate a payment gateway into the website is non-negotiable. Whether you run an online retail business, a subscription-based service, or offer any products or services via the Internet, a seamless and risk-free payment gateway integration is also a must to ensure a smooth user experience and build confidence among users.

In this article, we will guide you through the entire process of integrating a payment gateway into your website, from the point of selecting the best payment provider to the fitting of the system, eCommerce payment gateway integration, and its operation testing. After going through the whole of this article, you will be able to integrate a payment gateway into your website and ensure your customers transact with minimal pitfalls.

What is a Payment Gateway?

Thanks to payment gateways, it is now easier to carry out business-to-consumer transactions, as one can safely transfer account numbers, credit card numbers, and any other payment details from a website to the corresponding bank or payment processor.

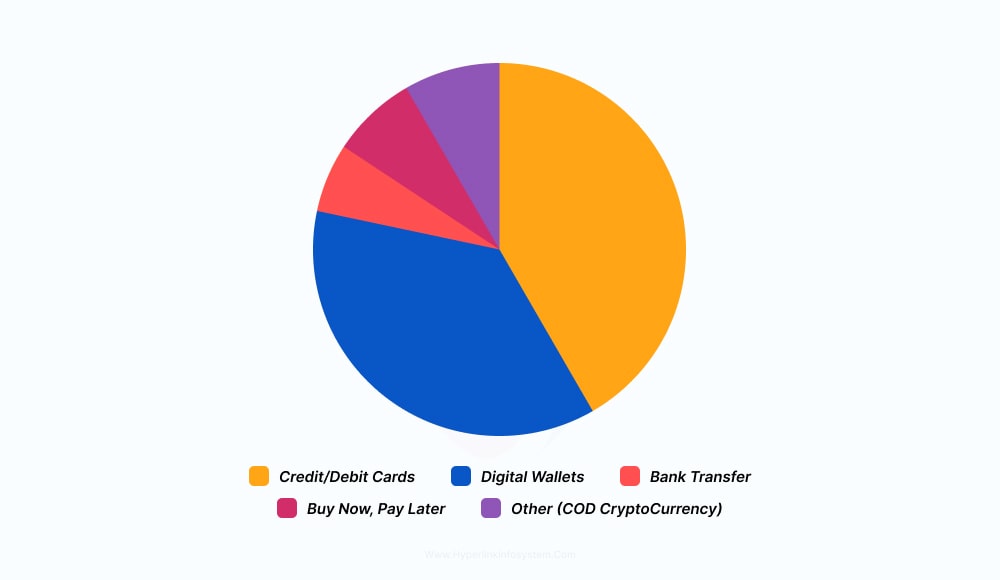

A gateway to a payment system also ensures that all payment data, for instance, the banks’ or credit card owners’ details, is provided in an encrypted form through the system as it would be done in real credit card terminals. This chart shows the Preferred Payment Methods by Global Online Shoppers (2023)

Settlement, authorization, and encryption are fundamental payment gateway integration components. These parameters help in encrypting the credit card information and other private information of the consumers. The payment gateways protect from fraud as they enable the bank, or even the payment processor, to validate a transaction. Once the payment processor settles the transaction, the customer's funds are transferred into the bank account of the store owner.

Therefore, implement payment gateway and getting a reliable payment gateway that is strong and will work to assist in risk-free payment over the Internet is very important for fraud mitigation, enhancing consumer and business confidence, and most importantly, allowing customers to pay over the Internet without risking them.

How do Payment Gateways Work?

A payment gateway refers to an online service that provides a secure way for securely transmitting the credit card data of a client to the bank account of the seller. Each transaction is subject to approval, authentication, and completion. thus, the process has various elements. The explanation of how a payment gateway works is divided into several stages:

1. The Website User Initiates The Payment

A user will be asked to provide their payment details, for instance, a credit or debit card number or another method of payment such as PayPal or even a bank wire, when he or she click on the payments button on the site or the landing page with payment gateway.

2. Data Security

To prevent loss of sensitive information such as card numbers and CVV codes, among other details, during movement, the payment gateway encrypts all the data after a customer has filled in their payment details.

3. Payment Processor Receives Payment Information

The payment processor, a financial institution that is responsible for completing the transaction, is the one who obtains the encrypted payment details. To obtain approval, the processor sends the details to the appropriate card network (Visa, Mastercard, etc.) or issuing bank.

4. Transactional Authorization

The bank or card scheme confirms the transaction data and to complete the purchase, they check the availability of sufficient funds or available credit. The payment information is confirmed with its documentation. No red flags are raised concerning the details submitted.

The issuing bank provides the payment processor with an authorization code (OTP) in case of transaction approval.

5. Response to Authorization for the Merchant

The payment gateway receives the permission answer from the payment processor and responds to the merchant's page on the website. The merchant will receive a notification and the customer will get an ‘order accepted’ message in the case where the transaction is approved.

6. Final Funds Settlement

Once the transaction is approved by the customer, the payment gateway procedure interacts with the bank of the merchant, also referred to as the acquiring, for the transfer of funds from the customer to that of the customer’s merchant. Depending on the bank and the payment gateway, this process called settlement takes a few days.

7. Completed Transaction

The purchase of the customer is completed upon the receipt of payment by the seller for the sale. The process is enjoyable for both the buyer and the seller because the entire transaction hardly takes a few seconds.

Some of the chief constituents of the basic functionality of a payment gateway include the following elements: The 'issuing bank' refers to the bank that issues a credit or debit card to a customer. An acquiring or merchant bank has an account at such an institution where the merchant receives money. A payment processor is a financial service that operates through a payment gateway integration during the processing of a transaction. Card networks are networks that facilitate the transfer of cash between financial institutions such as American Express, Visa, and MasterCard.

Simply put, a payment gateway encodes all the customer details, and this encoding has to be communicated to the relevant banks and payment processors to ensure that the transaction is completed efficiently and securely. For this reason, they are a key component in eCommerce, even hoping that they shall allow them to receive payments for goods and services via the Internet.

How to Integrate Payment Gateway In Website?

There are several stages in the integration of a payment gateway into a website to ensure reliable, secure, and convenient payment processing for the users. No matter you are building an online business, a subscription, or payment gateway for ecommerce website, safe payment gateways are very important. This is an elaborate guide that will help you integrate a payment gateway into your website:

1. Choose the Right Payment Gateway Supplier

The first consideration when setting up payment on website is selecting the appropriate payment gateway. A payment gateway list includes PayPal, Stripe, Square, Authorize.Net, etc. Consider the following before settling on a provider:

- Transaction fees: Check what percentage of each transaction is retained.

- Geography limitations: Are there any gateways that accept overseas clients?

- Security features: does it offer firewall, tokenization, and SSL encryption?

- User experience: is it convenient for users to make payments and complete checkout?

- Developer resources: is it easy to integrate through any add-ons and application programming interfaces?

2. Opening a Merchant Account

Most payment processing gateways require the user to open an account first, known as a merchant account. It is a special kind of bank account that allows businesses to accept payments. Banks may or may not offer these special accounts; the majority of payment processors also use third-party services for providing merchant accounts as a business. To make sure that users are not inconvenienced by creating separate merchant accounts, some payment gateways, e.g., PayPal and Stripe, offer it as an all-in-one gateway.

3. Preparing the APIs Developers' Guide

For example, most payment gateways provide API documentation for the developers. There is an interface, called API (Application Programming Interface), through which a website communicates with a payment gateway or other such service to carry out transactions. For, Payment gateway API integration, some payment providers, i.e., Stripe or PayPal, also have wide payment API for website solutions, code snippets, and SDKs to facilitate their integration into different solutions—WordPress, Shopify, Bespoke, and so on.

4. Establish the Payment Gateway Plugin for the CMS Platform.

Of course, a more straightforward process is likely to be one where the actual CMS used for building your website would have built-in capabilities in this regard to add payment processing to website. For example, if you are using a CMS like WordPress, Magento, or Shopify, then it may be as easy as installing a few add-ons. Most of the payment gateway service providers offer prefabricated plug-ins to make it easier to integrate the payment gateway onto the website.

All of these can be easily found and installed from the WordPress plugin directory, specifically for WordPress: PayPal, Stripe, WooCommerce Payments, or similar.

For Shopify: in the case of Shopify, payment gateways can be integrated from the settings directly.

5. Using APIs for Custom Integration (For Custom Websites)

The payment gateway must be integrated by using the API of the provider for custom-made websites. This can be done by performing the following actions:

Step 1: Obtain API credentials: To perform any tasks that require interaction with the payment gateway, proper authentication mechanisms need to be used. For that, you will need to obtain some API credentials, such as public and secret keys obtained when signing up for a payment gateway.

Step 2: Setting Up a Payment Form. Your website should have completed payment forms from clients. These fields should be there: name, card number, expiration date, CVV, and billing address.

Step 3: Securely Manage Your Payment Form. The payment form should be encrypted with SSL protection for the security of your sensitive information.

Step 4: Adding the payment gateways. The encrypted form sends the payment details to a payment gateway for authorization.

Step 5: Handle Response: A response is given by the payment gateway as to whether the transaction is successful or not. According to this response, it is going to send a confirmation message back to the user or process the transaction. Hire web developers who have expertise in web and ecommerce development.

6. Examine the Integration

Post integration has taken place, it is especially important to carry out an integration test of the payment gateway using live and sandbox environments. Payment gateways usually have a testing phase with safe credit cards where every receipt is generated or paying rates modified for paywalls wherein diverse payment scenarios can be simulated (payment succeeding, payment not succeeding, cards being declined, etc.).

To put an answer for how to implement payment gateway, Ensure that every process, including entering the card information and making the order, is seamless. Other methods of payment should be tested. Use payment processing website designs for more fruitful outcomes.

7. Implement Security Measures

Online transaction safety is very important to protect your business and clients from any fraudulent activities. To implement payment gateway securely, protect the transfer of sensitive information, you should use an SSL certificate.

When it comes to accepting credit card payments, always utilize payment processors that are PCI-DSS compliant. Replace sensitive data (like card digits) with unique tokens to protect such information from getting compromised thanks to tokenization. To implement security measures, hire a top web development company like Hyperlink Infosystem.

8. Turn On Live Environment

After the integration is successfully conducted, you can move on to the live environment. To change your website payment configuration to accept real payments, please replace the sandbox credentials with the live API keys from your payment gateway provider.

9. Monitor and Maintain

To ensure perpetual security and efficiency, ensure that your system is supplemented with the latest security patches and downloads released by your payment processor company. After the launch of your payment processor, for example, watch over its transactions for anything glaring or uncommon, including failure in payment transactions or suspect activities.

How can Hyperlink InfoSystem help?

Integrating payment gateway solutions is what we at Hyperlink InfoSystem specialize in for all types of businesses, regardless of their styles. It does not matter if it is a tailored solution you are handling, an online shop, or a service that requires transactions regularly; our talented programmers will ensure that the best payment gateway is installed on your site for fast transaction processing with our payment integration services. To maintain high standards of security with adherence to PCI-DSS requirements and using SSL encryption and tokenization for message security, we assemble several gateways, including PayPal, Stripe, and Square, and provide effective usefulness to the users.

To prevent problems and guarantee a perfect live launch, our web development company not only manages the technical integration but also makes sure that extensive testing is done in sandbox settings. We provide continuous support and maintenance to keep your system updated with the newest security patches and features. Hyperlink InfoSystem is available to offer professional advice and a tailored strategy to satisfy your company's objectives if you're searching for a trustworthy partner to deploy safe and expandable payment gateway solutions.

Conclusion

In conclusion, adding a payment gateway to your site is important for providing your customers with the perspective of safe and simple transactions. You may speed up payments and increase the confidence of the users by choosing the right gateway with the proper integration and focusing on the security features. All of these will ultimately lead to the growth of the business and the satisfaction of the clients. Connect with a website development company for payment integration services.

FAQs

Q- What is the API of a payment gateway?

Ans. Using a payment gateway API integration, websites or applications can complete transactions, safely send payment details to the gateway, and reply with the results. This payment API for website can be used by developers to embed the payment functionalities of the gateway into their respective platforms.

Q- How do I take payments on my website?

Ans. A payment gateway for your website is a must, as this is where you will actually accept payments. Credit cards, digital wallets, and more may come without worry through custom API integration into your website or even the ease and convenience of CMS system plugins.

Q- What is an integrated payment gateway?

Ans. An integrated payment gateway is a payment processing system built into a website or application. This allows for the completion of transactions without redirecting users to another service provider.

Q- How to make a website with payment gateway?

Ans. An API can be used to integrate a payment gateway into your website but only if it is a custom-built site. Otherwise, it can be done using a plugin for websites developed on a content management system.

Q- How to set up payment on website?

Ans. Choose a payment gateway provider, sign up as a merchant and connect the gateway to your website using the gateway's API (for custom-coded websites) or a plugin for CMS platforms and start to take payments on your website. After this, test your process of paying out at your website so that all works fine and goes live in production.

Q- Which payment gateway is best?

Ans. Your company's needs will guide which payment gateway is right for you. Some of the most preferred options are Square, Paypal, and Stripe because they all provide secure transactions, easy integration, and accept different forms of payment.

Q- How do I choose a payment gateway for my website?

Ans. In selecting which payment gateway one will use for creating a website, one should consider transaction charges, modes of payment, security features, ease of integration, and after-sales support, among others.